How to File an Insurance Claim After Hurricane Helene

In the wake of Hurricane Florida storms like Hurricane Helene 2024, homeowners are often left to deal with the significant damage caused by high winds, flooding, and debris. Filing an insurance claim after such a disaster can be overwhelming, but knowing the steps to take can make the process smoother and ensure you receive the compensation you deserve.

This guide provides a step-by-step approach to filing a claim after Hurricane Helene or any other major storm. By following these tips, you can handle the aftermath of the storm efficiently and protect your home from further financial strain.

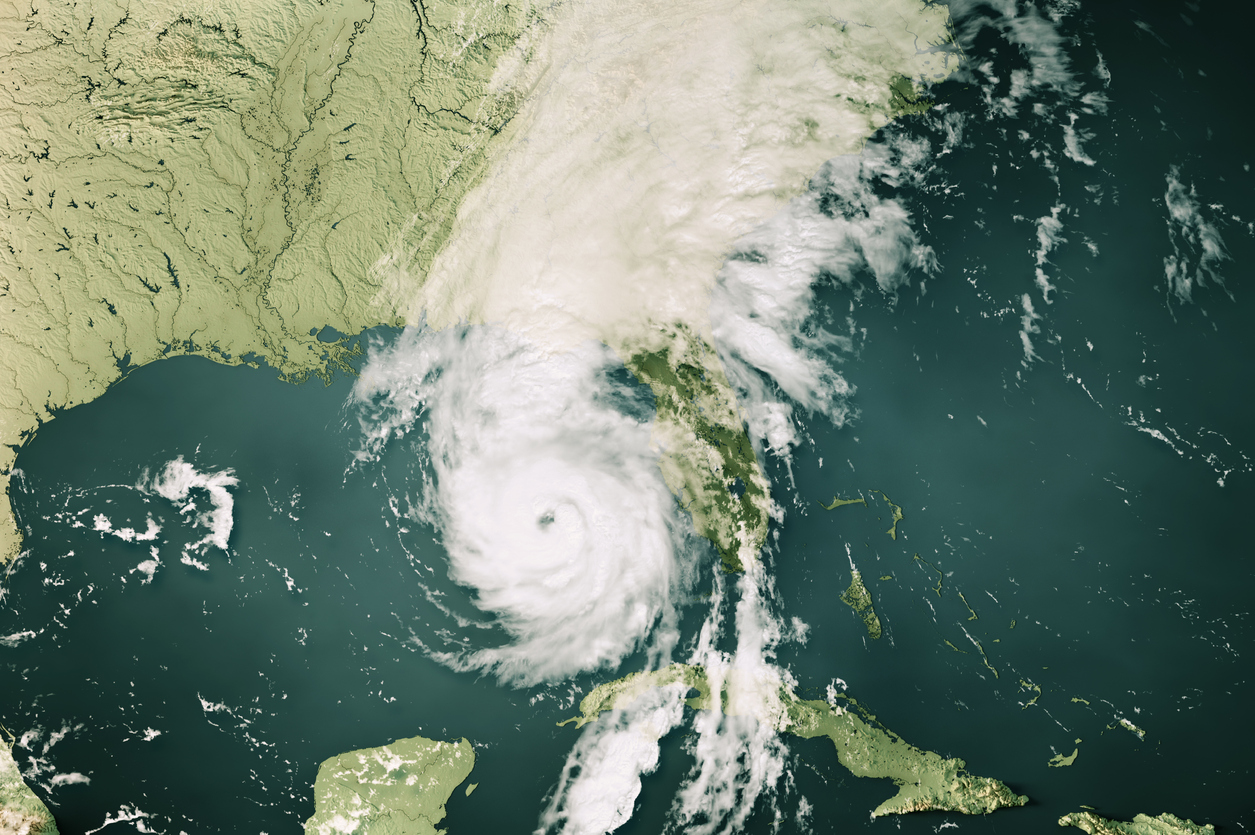

Understanding the Impact of Hurricane Helene

Hurricane Helene 2024 made a significant impact on homeowners throughout Florida, causing widespread damage. The storm brought severe winds, heavy rain, and dangerous flooding, which led to damaged roofs, broken windows, water intrusion, and destroyed personal property. As Florida is prone to hurricanes, understanding how to handle an insurance claim in the aftermath of these natural disasters is crucial.

Step 1: Assess the Damage After Hurricane Helene

Before filing an insurance claim, it’s essential to assess the damage to your property after the storm passes. This will help you document the extent of the destruction and prepare for discussions with your insurance company.

Key Areas to Inspect

- Roof: Look for missing shingles, leaks, or signs of structural damage.

- Windows and Doors: Check for cracks, shattered glass, or water intrusion around window frames.

- Siding and Exterior Walls: Inspect for loose or damaged siding, cracks, or holes caused by flying debris.

- Interior Water Damage: Look for water stains on ceilings, walls, or floors, indicating leaks or flooding.

- Personal Property: Document any damaged or destroyed belongings, such as electronics, furniture, or appliances.

It’s important to take clear photos and videos of all the damage, as this documentation will be critical when filing your claim.

Step 2: Contact Your Insurance Company Immediately

Once you’ve assessed the damage, contact your insurance company to start the claims process. Most insurance policies have a time limit for filing claims after a disaster like Hurricane Helene, so it’s essential to act quickly.

Information to Provide

- Your policy number

- A description of the damage

- Photos and videos of the affected areas

- Any immediate repairs you’ve made (e.g., tarping the roof, boarding windows)

Your insurance company will assign an adjuster to assess the damage and determine the payout for repairs.

Step 3: Make Temporary Repairs to Prevent Further Damage

While you’re waiting for the insurance adjuster to inspect your home, it’s your responsibility as a homeowner to prevent further damage to your property. If you fail to do so, your insurance company may reduce the payout.

Examples of Temporary Repairs

- Tarping a Leaky Roof: Cover any exposed or leaking areas of your roof with a waterproof tarp to prevent further water damage.

- Boarding Up Broken Windows: Secure broken or damaged windows with plywood to keep out the elements.

- Drying Out Water-Damaged Areas: Use fans or dehumidifiers to dry out any areas affected by flooding to prevent mold growth.

Make sure to keep all receipts for materials or services used in these temporary repairs, as your insurance company may reimburse these expenses.

Step 4: Meet with the Insurance Adjuster

The insurance company will send an adjuster to assess the damage to your property. It’s essential to be present during this inspection to ensure the adjuster sees all the damage and accurately documents it.

Tips for Working with the Adjuster

- Walk the Adjuster Through Your Property: Point out all areas of damage, both inside and outside your home. Don’t assume the adjuster will notice everything.

- Provide Documentation: Share the photos and videos you took immediately after the storm to back up your claim.

- Discuss Immediate Repairs: If you made any temporary repairs, show the adjuster the work and provide receipts for materials or labor costs.

If you feel that the insurance adjuster isn’t accounting for all the damage, consider hiring a public adjuster to represent your interests. Public adjusters work independently and can help you negotiate a higher payout if the initial offer is too low.

Public Adjusters Orlando FL can assist you in navigating the claims process and ensure you receive a fair settlement.

Step 5: Get Repair Estimates from Contractors

Once the adjuster has inspected your home, it’s time to get estimates from licensed contractors for the necessary repairs. Make sure you choose reputable contractors who have experience with storm damage repair.

Key Points for Choosing Contractors

- Get Multiple Estimates: Obtain quotes from at least three contractors to compare pricing and the scope of work.

- Check Licenses and Insurance: Make sure the contractor is licensed and insured to protect yourself from liability in case of accidents.

- Ask for References: Check reviews or ask for references from previous clients to ensure the contractor’s quality of work.

Providing these estimates to your insurance company will help ensure that the payout is sufficient to cover the full cost of repairs.

Common Problems Homeowners Face with Hurricane Claims

Filing an insurance claim after a major storm like Hurricane Helene can come with its challenges. Here are some common issues homeowners face and how to address them:

1. Low Settlement Offers

Insurance companies may offer a lower settlement than expected, especially if they underestimate the cost of repairs.

Solution: If you receive a low offer, don’t accept it right away. Provide additional documentation, such as repair estimates from contractors, to justify a higher payout. If necessary, consider hiring a public adjuster to negotiate on your behalf.

2. Delays in Processing Claims

After major hurricanes, insurance companies often face a large volume of claims, which can lead to delays in processing.

Solution: Stay in regular contact with your insurance company to check the status of your claim. Keep detailed records of all communications, including dates and the names of the representatives you speak with.

3. Denied Claims

In some cases, insurance companies may deny claims if they believe the damage was due to a cause not covered by the policy.

Solution: Review your insurance policy carefully to understand what is and isn’t covered. If you believe your claim was wrongfully denied, consider filing an appeal with additional documentation or hiring a public adjuster to advocate for you.

How a Public Adjuster Can Help with Hurricane Helene Claims

If you’re struggling with your hurricane damage claim or feel you’re not receiving a fair payout, a public adjuster can help. Public adjusters are independent professionals who work on behalf of homeowners to ensure they receive the maximum compensation from their insurance company.

Benefits of Hiring a Public Adjuster

- Expert Knowledge: Public adjusters have extensive experience in handling insurance claims and can navigate the complex claims process more effectively than homeowners.

- Negotiation: Public adjusters will negotiate with the insurance company to ensure you receive a fair payout based on the full scope of the damage.

- Faster Resolution: With a public adjuster managing your claim, the process may be expedited, allowing you to begin repairs sooner.

For more information on how a public adjuster can help with your claim after Hurricane Helene, visit Hurricane Damage Claim.

Conclusion: Take Action After Hurricane Helene

Filing an insurance claim after Hurricane Helene 2024 can be a complex process, but by following the steps outlined in this guide, you can ensure that your claim is processed smoothly and that you receive the compensation you deserve.

Be proactive by documenting all damage, working closely with the insurance adjuster, and getting repair estimates from trusted contractors. If you encounter any challenges during the claims process, don’t hesitate to seek help from a public adjuster to ensure your home is properly restored.

Take action now to protect your home and your finances by filing your claim and preparing for future storms. For more support, explore resources like Public Adjusters Orlando FL to help with your hurricane claims.